Impact

The common mission of AECM members is to support small and medium-sized enterprises to get access to finance. Credit guarantee schemes are according to the OECD the most widespread instrument to overcome market failure in the area of SME finance.

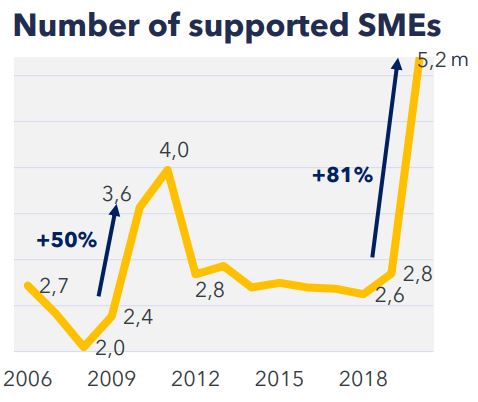

In addition to that, guarantee schemes take up a counter-cyclical role in times of economic stress. This can be seen by an increase of 25% of the outstanding guarantee volume of AECM members during the financial crisis of the late noughties and an even much more pronounced increase of 200% during the covid crisis. The number of supported SMEs increased by 80% in 2020 (see graphs below). This development is due to the extensive support measures set up by guarantee institutions in cooperation with their respective governments, the European Commission and the EIB Group. These bold interventions allowed to prevent a massive insolvency followed by a severe credit crunch.

Graph 2: Development of the number of supported SMEs in the portfolios of AECM members (in units)

According to the most recent available data, guarantee institutions in Europe support almost 5.2 million SMEs. Their outstanding guarantee volume is EUR 330 billion (end of 2020). These descriptive numbers already suggest that the impact in terms of economic additionality (improvement in the supported firms’ performance in issues such as investment, profitability, etc.) and financial additionality (improving access to credit and reducing its cost) is significant. Impact evaluations are undertaken in order to prove this intuition scientifically.

Guarantee institutions are accountable towards their shareholders and to providers of any kind of counter-guarantee. That is why they engage more and more in the evaluation of their impact and this with the aim to demonstrate their positive impact on the economy. In some cases these studies are undertaken internally, and in other cases by research institutes, consultancies, universities, governments or industry bodies (associations, chambers, etc.) or in cooperation with such entities.

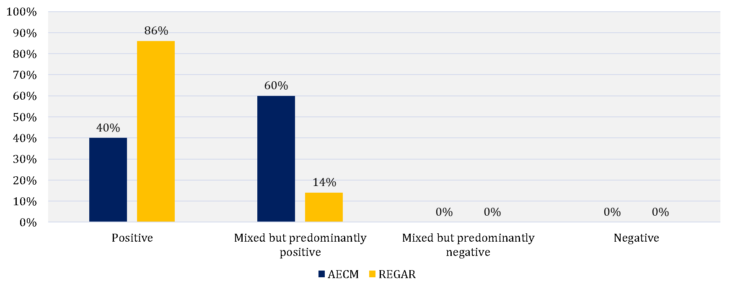

According to a 2019 joint survey of AECM and our partner REGAR (the Ibero-American network of guarantee institutions), 12 out of 18 AECM respondents stated that their organisation evaluated its impact. The results of these studies are encouraging. Whereas 40% of the studies found exclusively positive results, 60% of the studies found mixed but predominantly positive results. No member reported about negative results in an impact assessment (see graph below).

Graph 3: Classification of impact studies by results

Not all studies are publicly available. The following presentation shows therefore only an extract of undertaken impact studies (section in the Statistical Yearbook 2019). Short summaries on recent impact studies can be also found in the impact section of the Statistical Yearbook 2020.

The following quotes give an overview of the findings of such impact studies:

“[…] guaranteed firms receive an additional amount of credit equal to 7-8 percent of their total banking exposure. We also estimate a reduction of about 50 basis points in interest rates applied to term loans granted to guaranteed firms.”

Ciani, E., Gallo, M., & Rotondi, Z. (2020). Public credit guarantee and financial additionalities across SME risk classes . Bank of Italy.

“[…] credit guarantees are positive for company access to debt finance, […]. Less is known about the financial sustainability of these programmes. Results are mixed, however, with respect to economic additionality. There is some evidence that CGS have positive effects on employment levels while there is a lack of evidence for improved company performance […].”

Schich, S., Cariboni, J., Naszodi, A., & Maccaferri, S. (2017). Evaluating publicly supported Credit Guarantee Programmes for SMEs.

“In many countries, Credit Guarantee Schemes represent a key policy tool to address the SME financing gap, while limiting the burden on public finances. […] The credit guarantee mechanism is a commonly used response to this market failure.”

OECD. (2013). SME and entrepreneurship financing: The role of credit guarantee schemes and mutual guar antee societies in supporting finance for small and medium‐sized enterprises.

“The findings confirm the presence of a causal relationship between the public guarantee and the higher debt leverage of guaranteed firms, as well as their lower debt cost. “

“The cost reduction is evaluated as being in the range of 16–20%, while the additional supply of credit by banks is estimated at 12.4% at the median.”

Zecchini, S., & Ventura, M. (2009). The impact of public guarantees on credit to SMEs. Small Business Economics.

“[…] each [MGI] member [of a Mutual Guarantee Institution] contributes to the guarantee fund that is then posted as collateral to loans granted to MGI members. As a consequence, MGI willingness to post collateral signals firms creditworthiness to banks. The econometric analysis supports the hypothesis that these consortia improve lending conditions for small firms.”

Columba, F., Leonardo, G., & Paolo Emilio, M. (2008). Firms as monitor of other firms: mutual guarantee institutions and SME finance.

“[…] small firms supported by MGIs less likely experienced financial tensions even at that time of utmost financial stress. Second, our empirical evidence shows that MGIs played a signaling role beyond the simple provision of collateral. This […] suggests that the information provided by MGIs turned out to be key for bank-firm relations as scoring and rating systems – being typically based on pro-cyclical indicators – had become less informative during the crisis.”

Bartoli, F., Ferri, G., Murro, P., & Rotondi, Z. (2013). Bank–firm relations and the role of Mutual Guarantee Institutions at the peak of the crisis. Journal of Financial Stability.

At association level the activity in the area of impact is quite vivid. The topic is regularly discussed within the Working Group Statistics and Impact. In September 2019, we had an Operational Training Session (OTS) on Impact in Porto/Portugal. A report of this OTS is available in the AECM member area. In 2018, Impact was the topic of the seminar of the AECM annual event in Warsaw. Furthermore, AECM engages in a joint task force on impact that includes experts from AECM and members, EIF, FIRA, OECD, REGAR, SBA USA and different universities.